A Data-Driven Assessment of HCSC’s Medicare Advantage Landscape vs A.I.

- UpSkill Tools

- Jun 18, 2025

- 2 min read

Introduction

In the rapidly shifting world of Medicare Advantage, insurers must adapt to changing demographics, policy updates, and competitive pressure. HCSC (Health Care Service Corporation) stands at a crossroads, armed with the recent Cigna Medicare acquisition and a large untapped population in key regions. Our analysis reveals that over 350,000 Medicare-eligible individuals remain unenrolled in just eight focus states.

The question is: how can HCSC reach them?

HCSC’s Challenge and Expansion Goals

The dual challenge lies in managing increasing competition while also leveraging newly acquired territories. With CMS and U.S. Census data, we identified market dynamics across five core HCSC states—Texas, Illinois, Oklahoma, New Mexico, and Montana—and three expansion states from the Cigna acquisition—Florida, Alabama, and Tennessee.

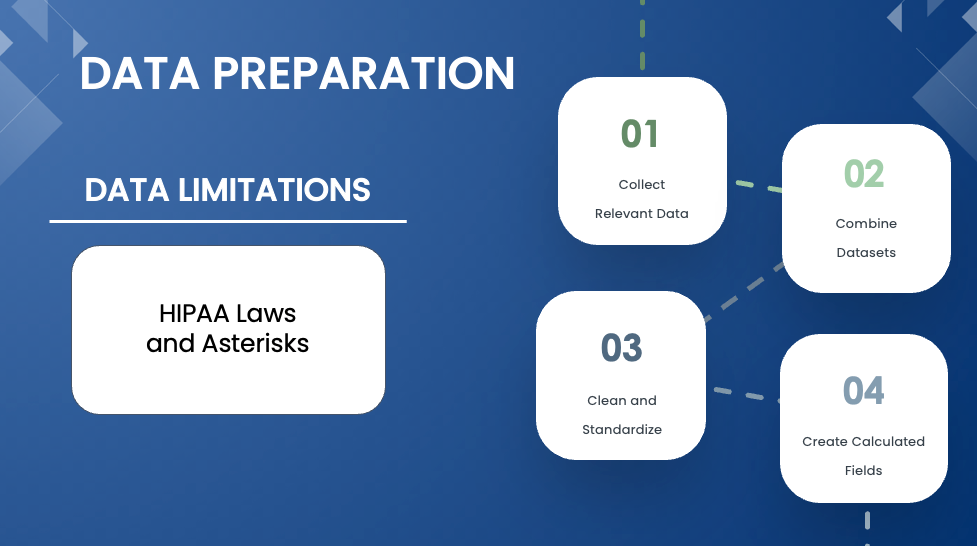

Data-Driven Methods & Tools

We cleaned and merged CMS monthly enrollment files, U.S. Census population data, and SDOH datasets using FIPS codes. Tools like SQL and Tableau helped visualize trends, analyze market share, and support evidence-based recommendations. Due to HIPAA limitations, we used proxy metrics like 65+ population instead of individual data. Nevertheless, our models remained statistically sound and scalable.

Where HCSC Stands Today?

HCSC has made significant progress in states like Illinois, capturing over 11% market share. Despite its massive senior population in Texas, HCSC commands only 2.8%. New Mexico and Oklahoma show moderate growth, while Montana remains stable but rural. These patterns expose both strengths and blind spots.

Competitor Insights

National players like UnitedHealth and Humana dominate much of the Medicare Advantage space. In our market share review, HCSC did not appear in the top tiers in most states. However, our year-over-year growth analysis reveals upward trends—especially between 2022 and 2024—suggesting momentum is building.

Opportunity Path A: Replicate Current Success

By analyzing top-performing counties like Cook (IL), DuPage (IL), and Harris (TX), we identified common traits: moderate poverty rates, unemployment between 4–8%, and high Medicare-eligible populations. Using these criteria, we found similar counties in Cigna states—such as Palm Beach (FL) and Shelby (TN)—with over 200,000 potential enrollments.

Opportunity Path B: Underserved Territories

Our cluster analysis flagged counties with penetration below 50% as growth targets. While some have smaller populations (e.g., Meagher County, MT), their low enrollment rates suggest room to grow. These areas represent an additional 147,000 Medicare-eligible individuals.

AI-Backed Validation

We tested our logic with AI models, including ChatGPT and Grok. Both confirmed our findings, highlighting urban expansion (Path A) and rural targeting (Path B) as valid approaches. While AI offered an extra perspective, it also showed the importance of human-led data validation.

Strategic Next Steps

HCSC has a powerful opportunity ahead. They can capture a substantial share of the Medicare Advantage market by doubling down on proven strategies, entering matched counties in Cigna states, and focusing on underserved regions. With over 350,000 lives on the line, this isn’t just about business—it’s about impact.

Research done by Andrey Fateev, Brent Buchtel, Zachary Ordeneaux

Comments